Investment Sectors

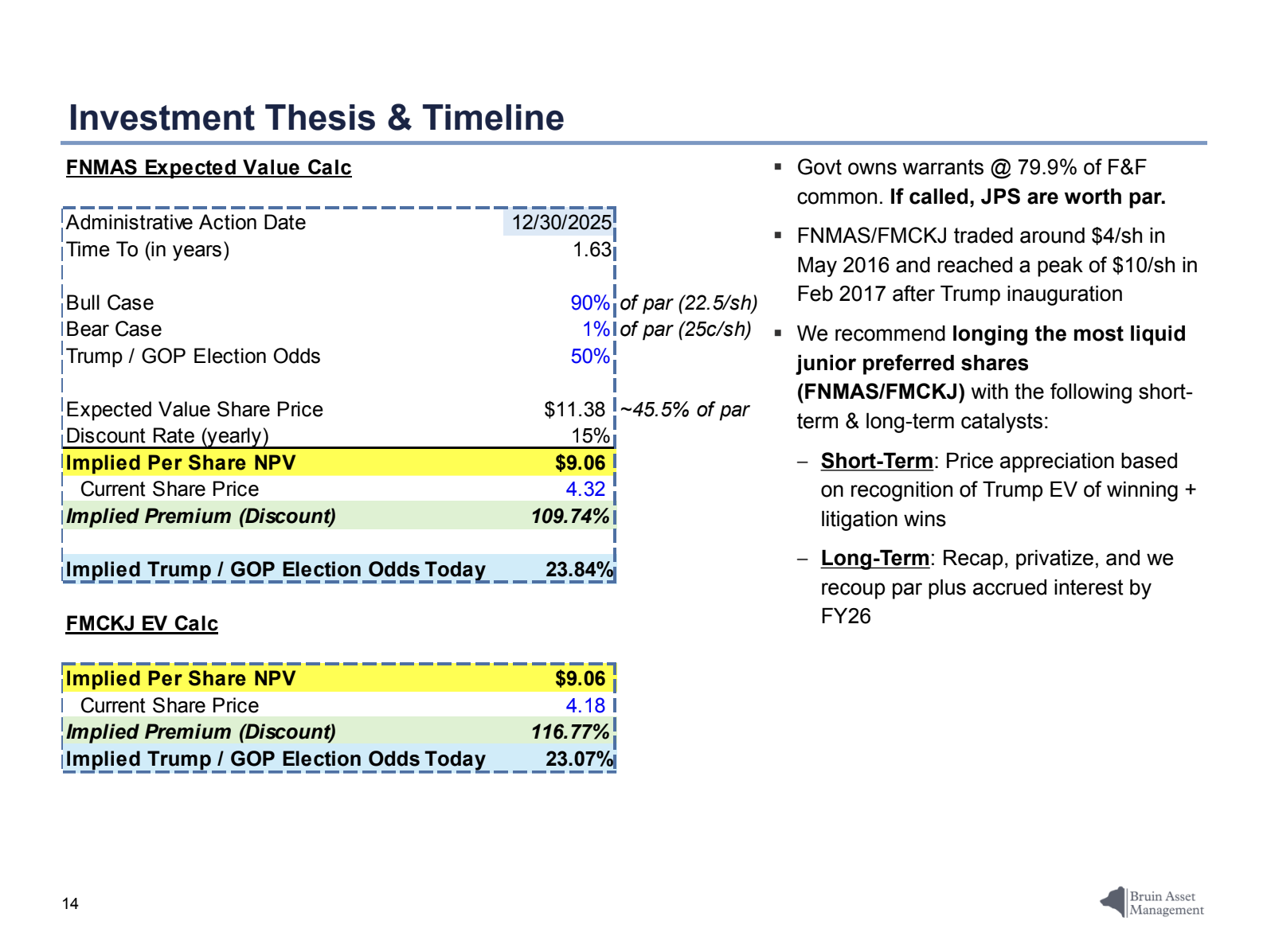

Tactical Opportunities

BAM’s Tactical Opportunities Investment Sector focuses on situation-based investing, where unique circumstances create compelling risk-reward profiles. This includes event-driven strategies such as mergers and acquisitions, restructurings, spin-offs, distressed assets, and other special situations that may unlock value overlooked by the broader market. Our members learn to analyze catalysts, timing, and market psychology while balancing upside potential with downside risk. By engaging with these complex, fast-moving opportunities, students gain practical experience in developing creative investment theses and thinking critically under uncertainty.

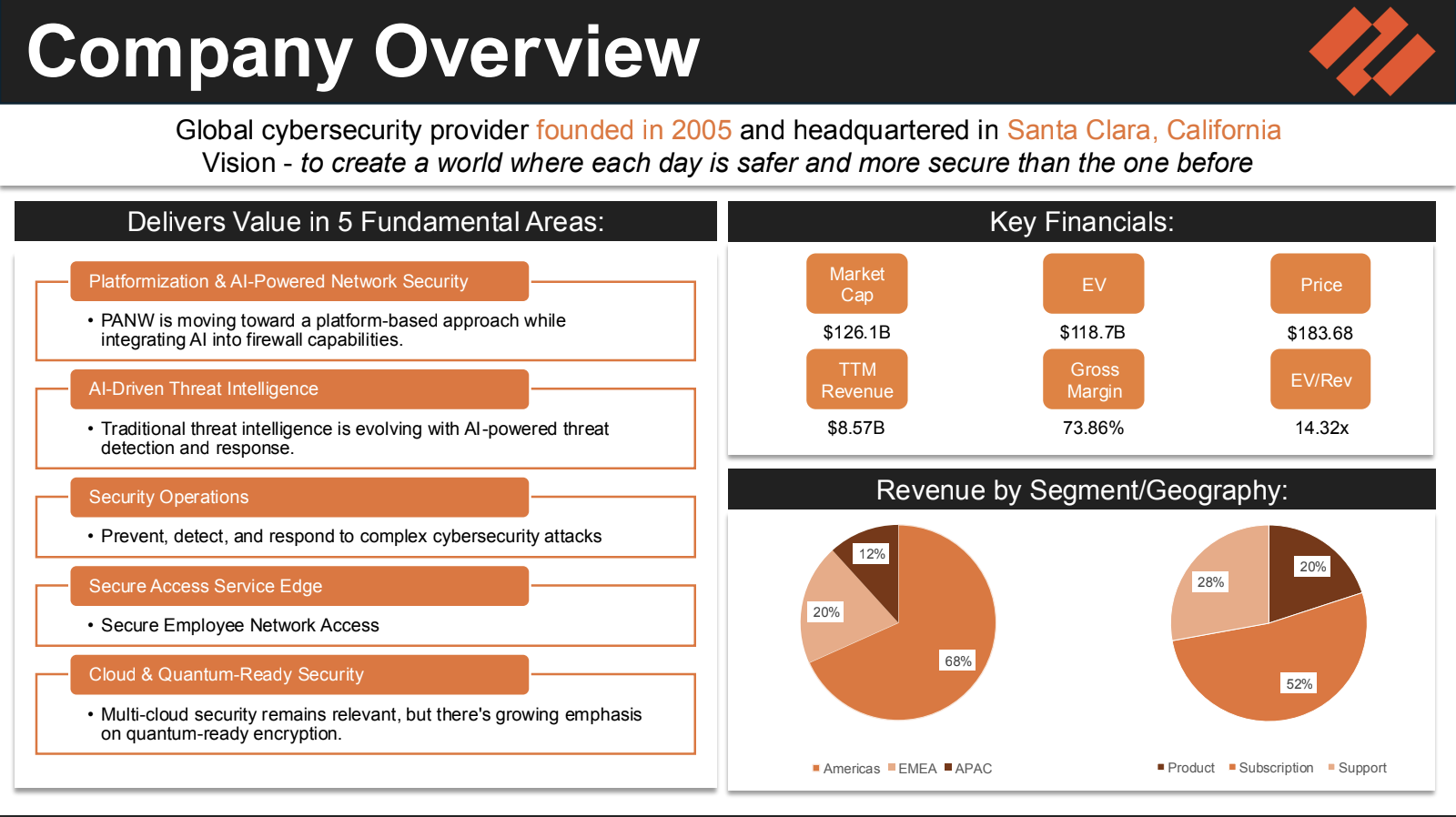

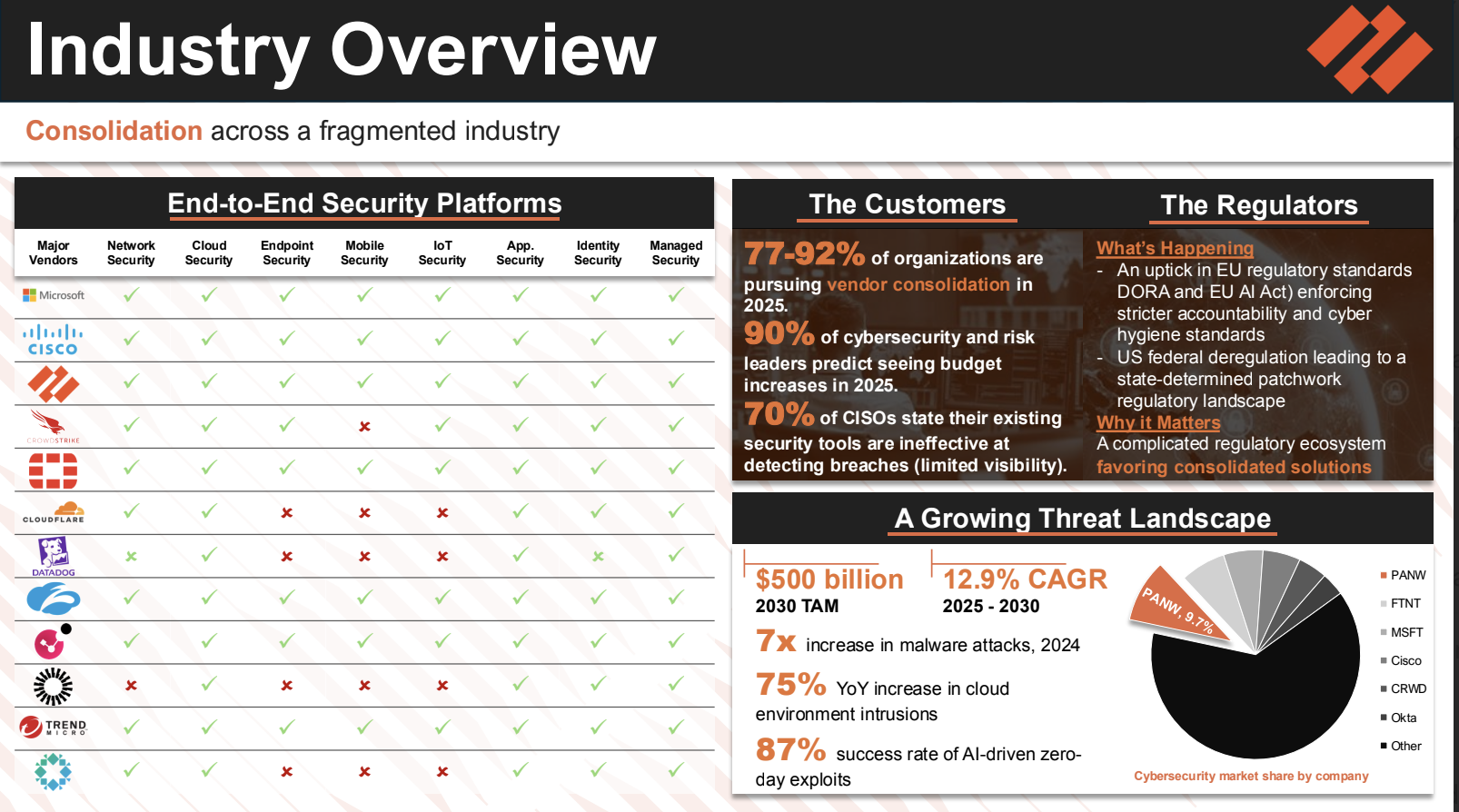

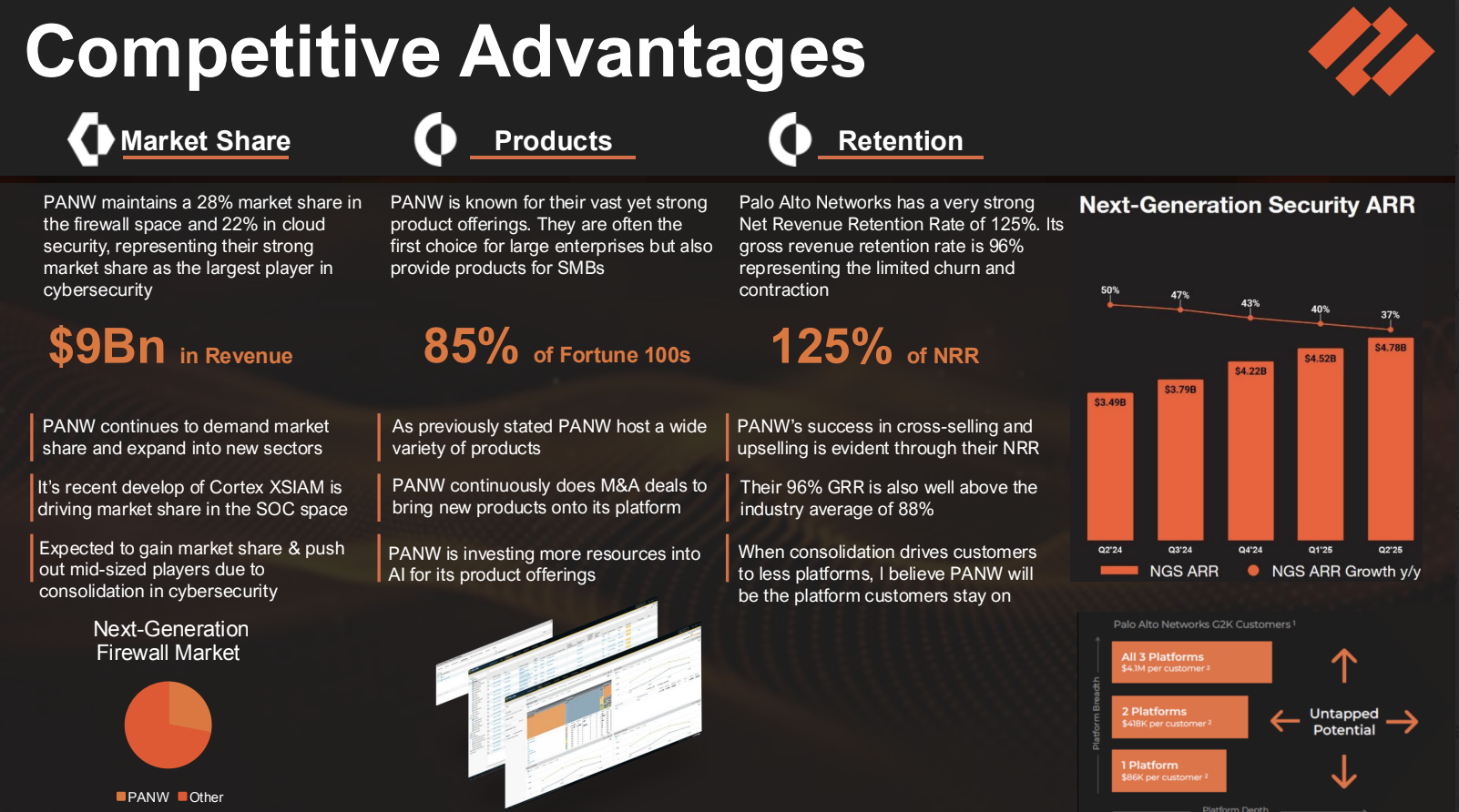

Software

BAM’s Software Investment Sector focuses on identifying opportunities across the rapidly evolving technology landscape. Our members analyze companies within key software verticals—including enterprise SaaS, cybersecurity, fintech, cloud infrastructure, and artificial intelligence platforms—evaluating both established leaders and emerging innovators. By studying industry trends, competitive dynamics, and long-term growth drivers, we build informed investment theses that capture the transformative potential of software businesses. This sector gives members hands-on exposure to one of the fastest-growing areas of the market.

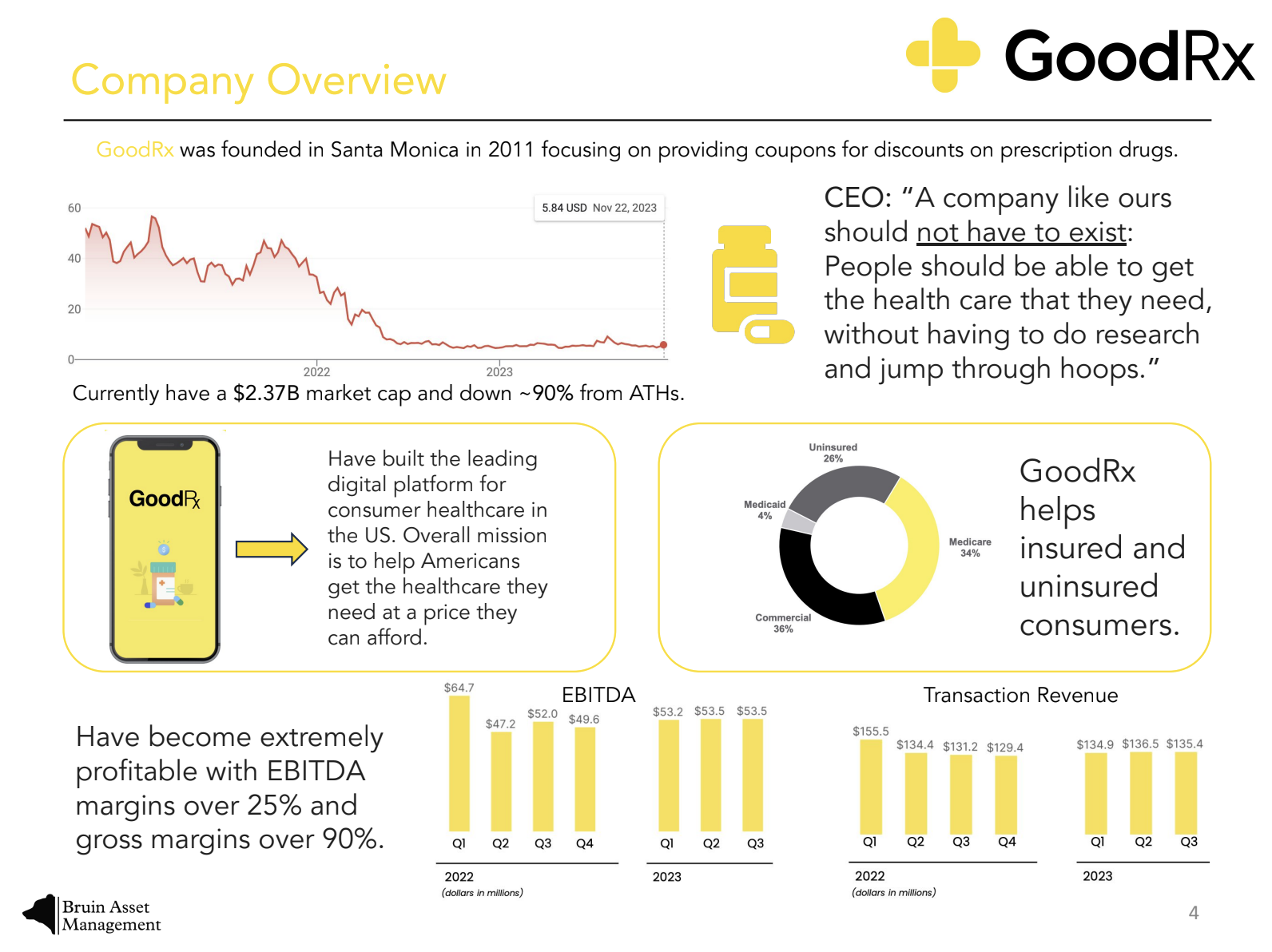

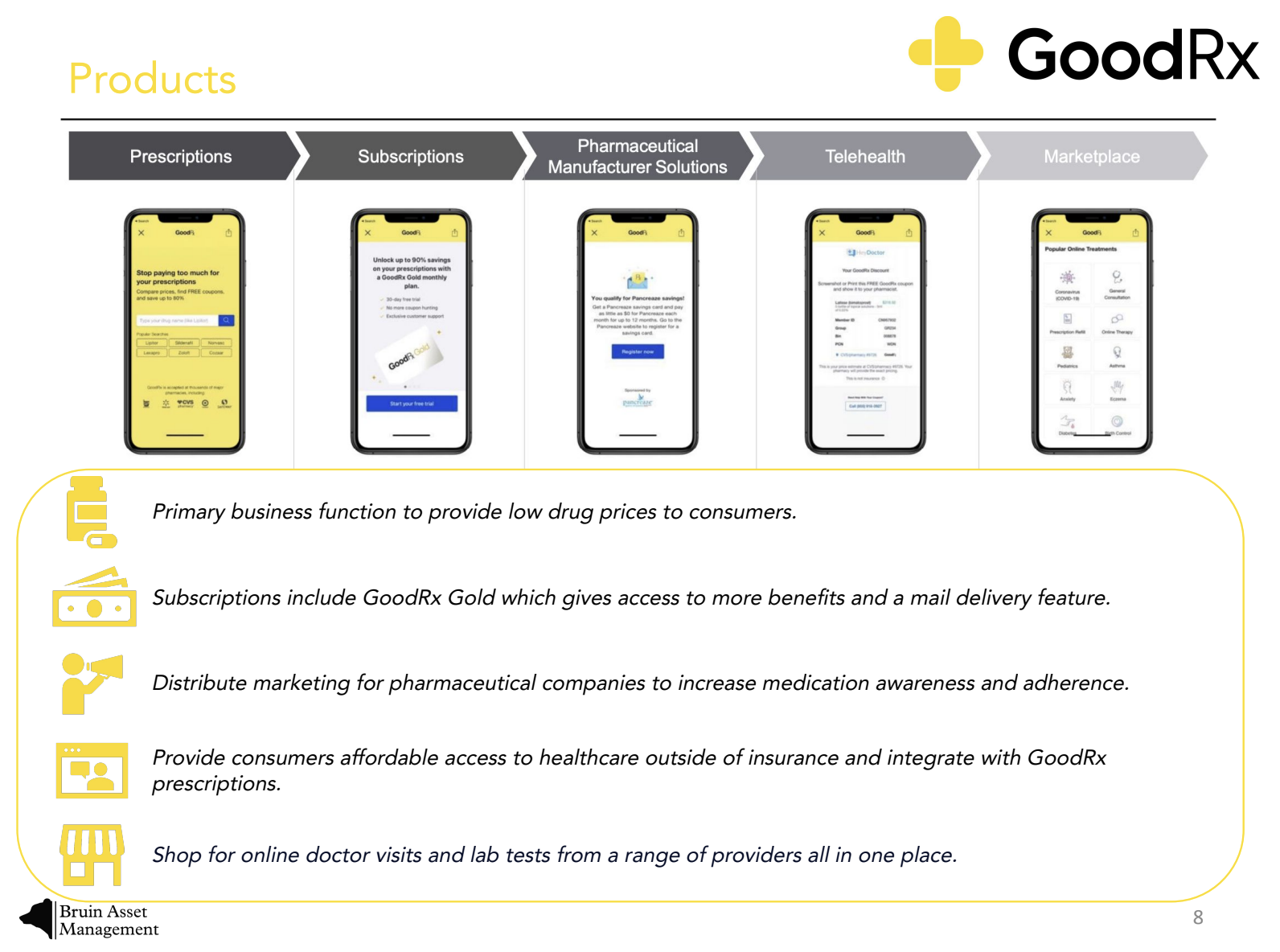

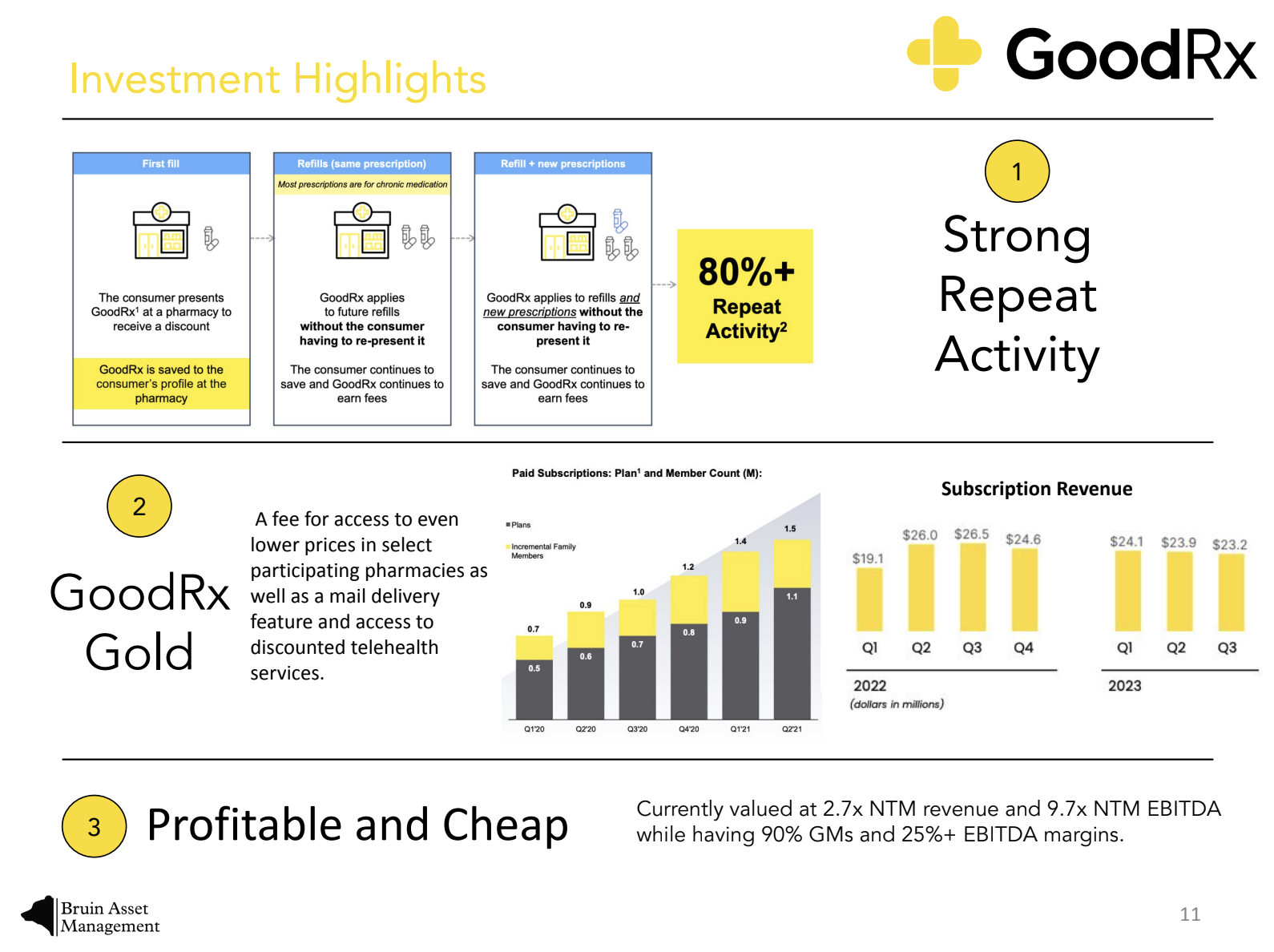

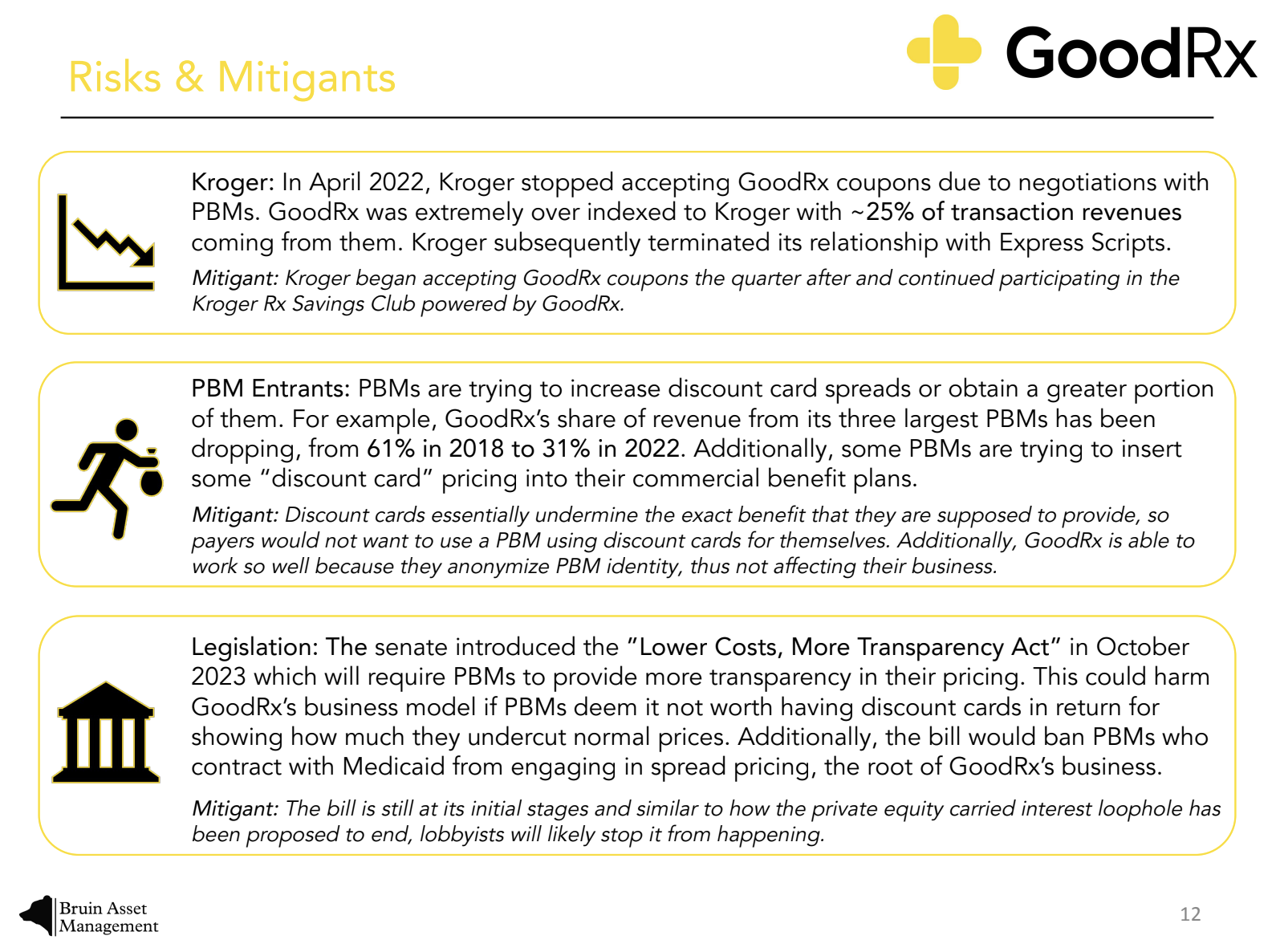

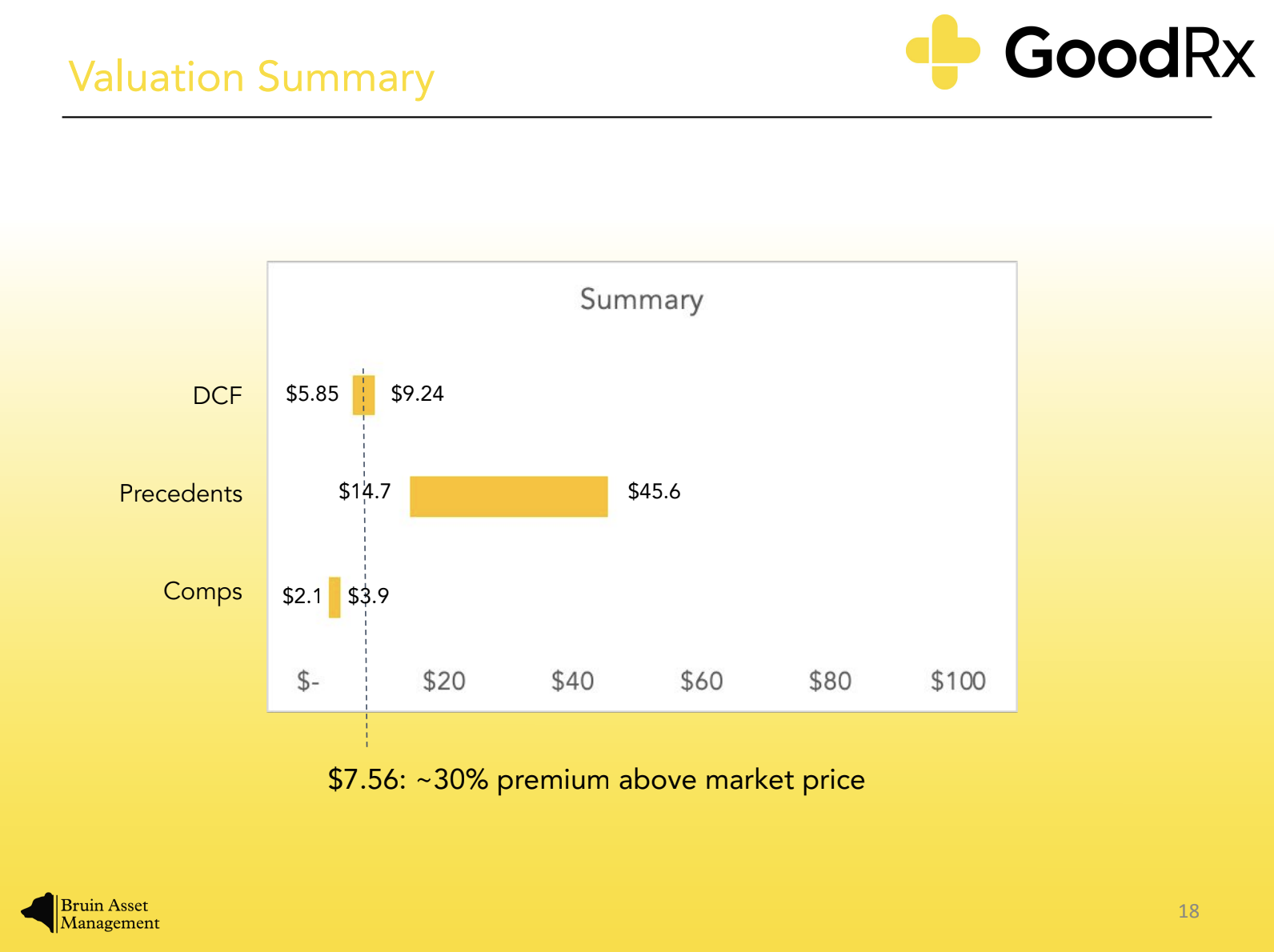

Healthcare

BAM’s Healthcare Investment Sector analyzes companies at the intersection of medicine, technology, and innovation. Our coverage spans pharmaceuticals, biotechnology, medical devices, healthcare services, and digital health. Members study industry drivers such as regulatory developments, drug pipelines, demographic trends, and technological advancements to identify both growth opportunities and defensive investments. By exploring the complexities of healthcare markets, students gain the tools to evaluate companies that not only drive financial returns but also shape the future of global health.

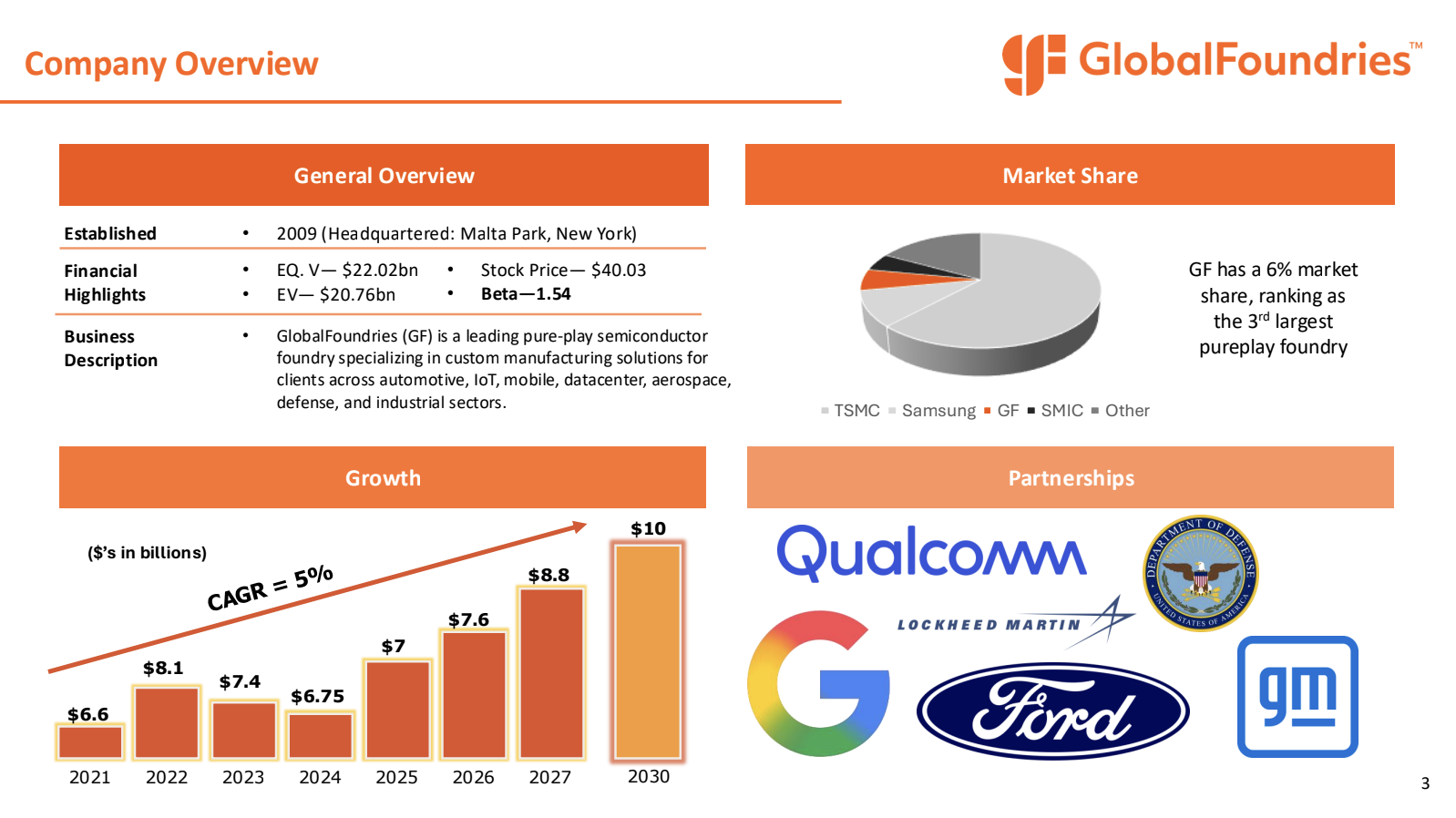

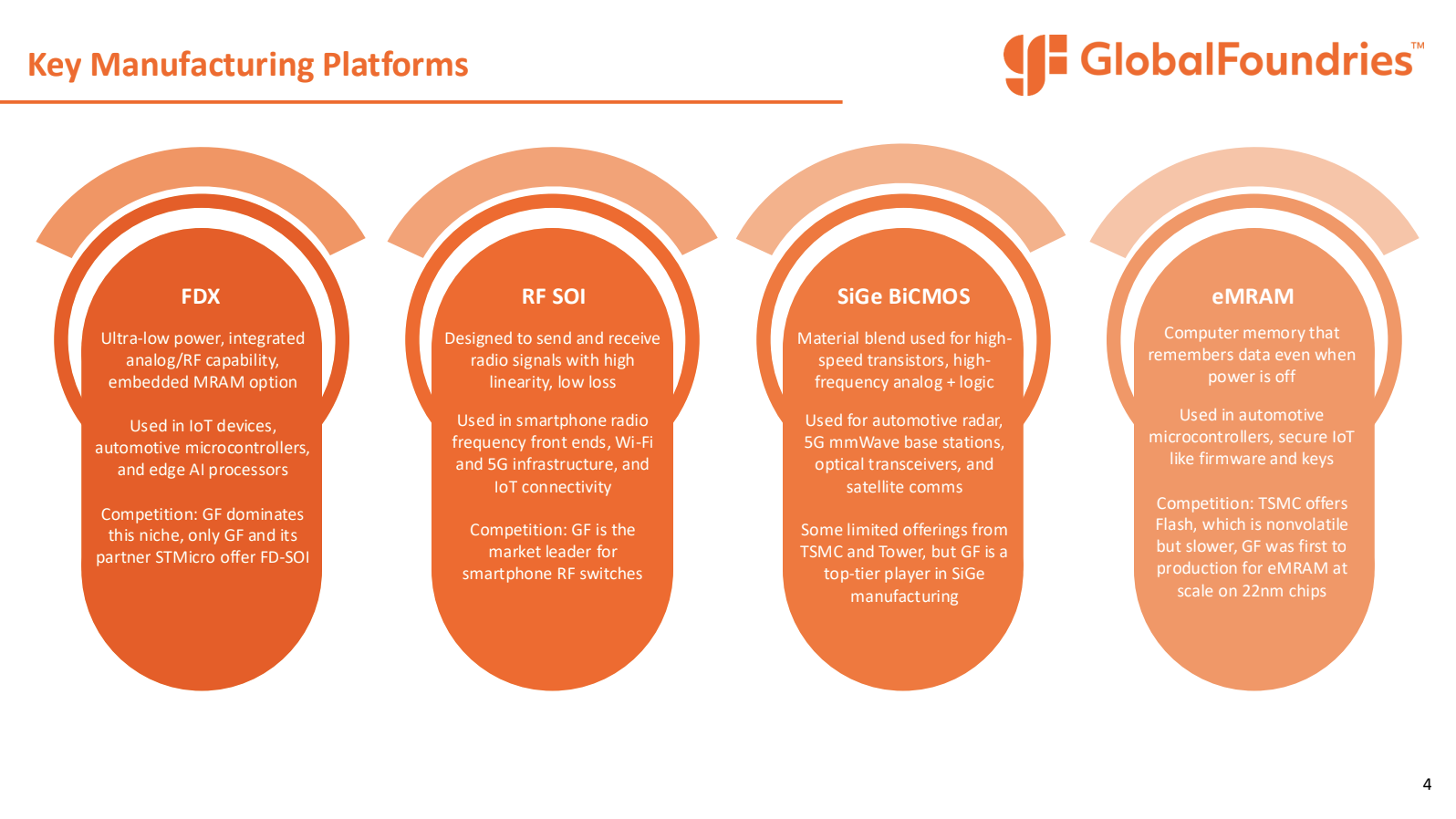

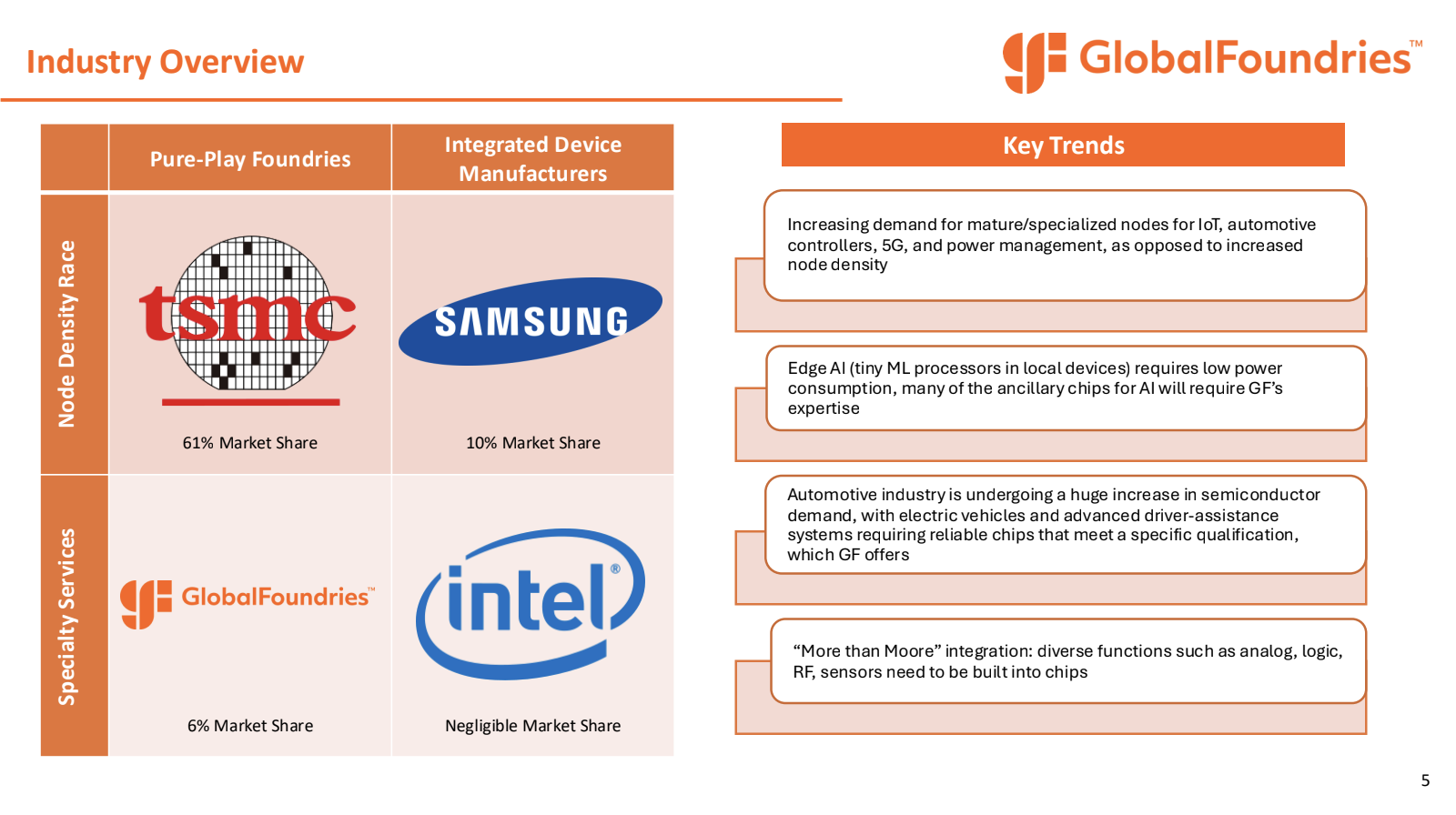

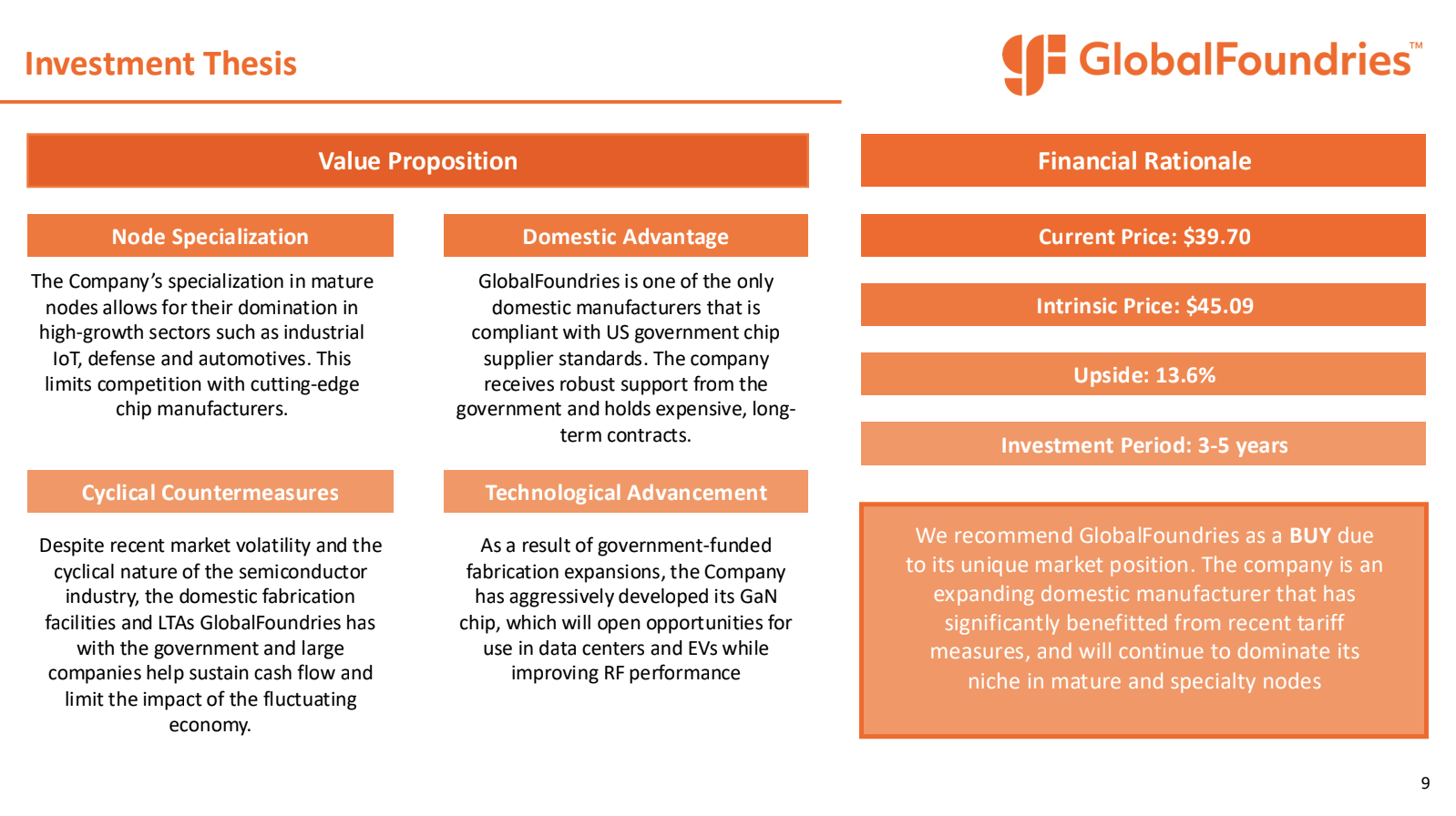

Hardware

BAM’s Hardware Investment Sector emphasizes the analysis of companies that design, manufacture, and distribute the physical technologies powering our modern world. This includes verticals such as semiconductors, consumer electronics, networking equipment, and emerging technologies like autonomous systems and edge devices. Our members study supply chain dynamics, capital intensity, and innovation cycles to develop well-rounded investment theses. By examining both established industry leaders and disruptive challengers, students gain a deep understanding of the hardware landscape and its critical role in driving global technology growth.

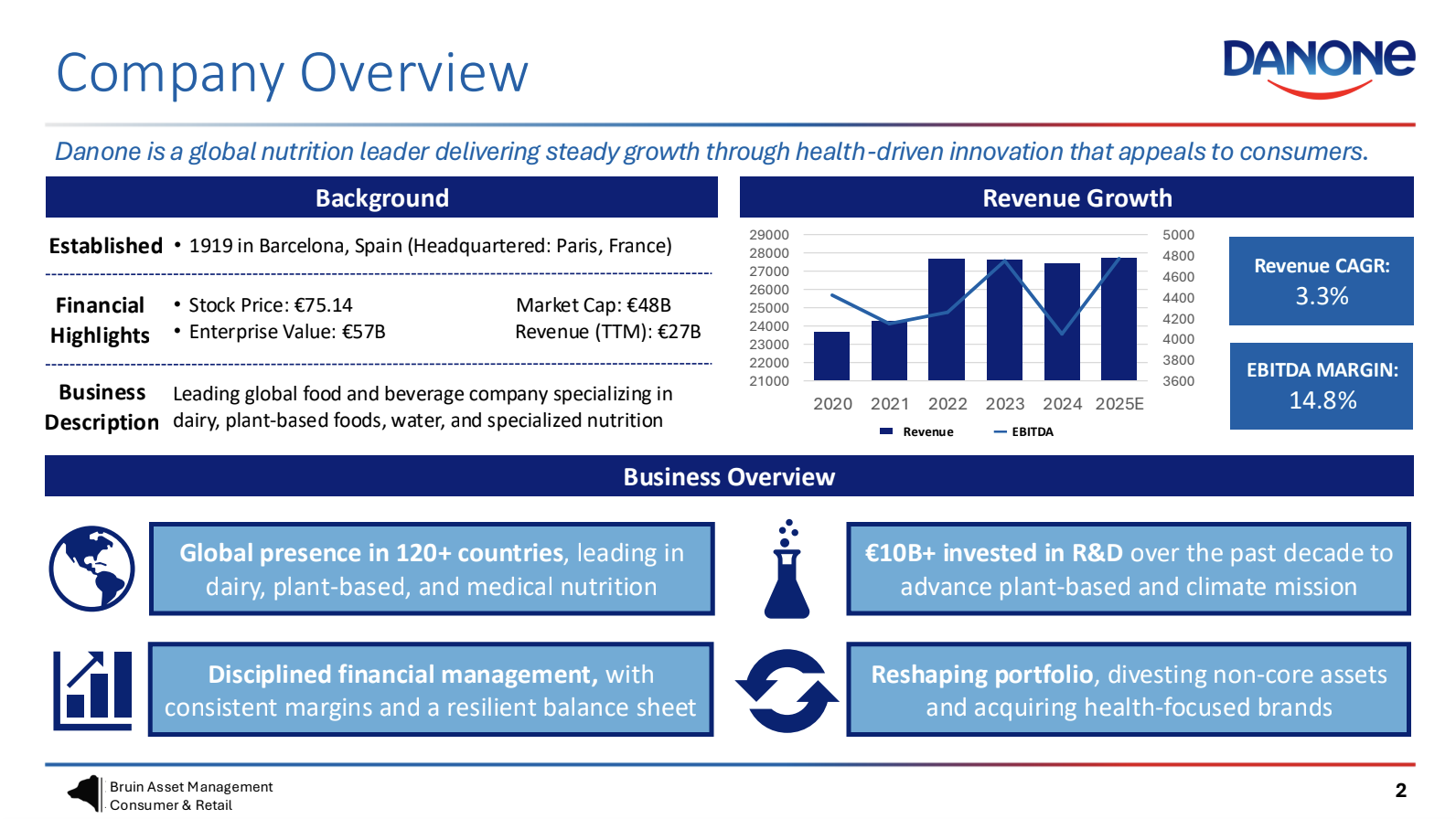

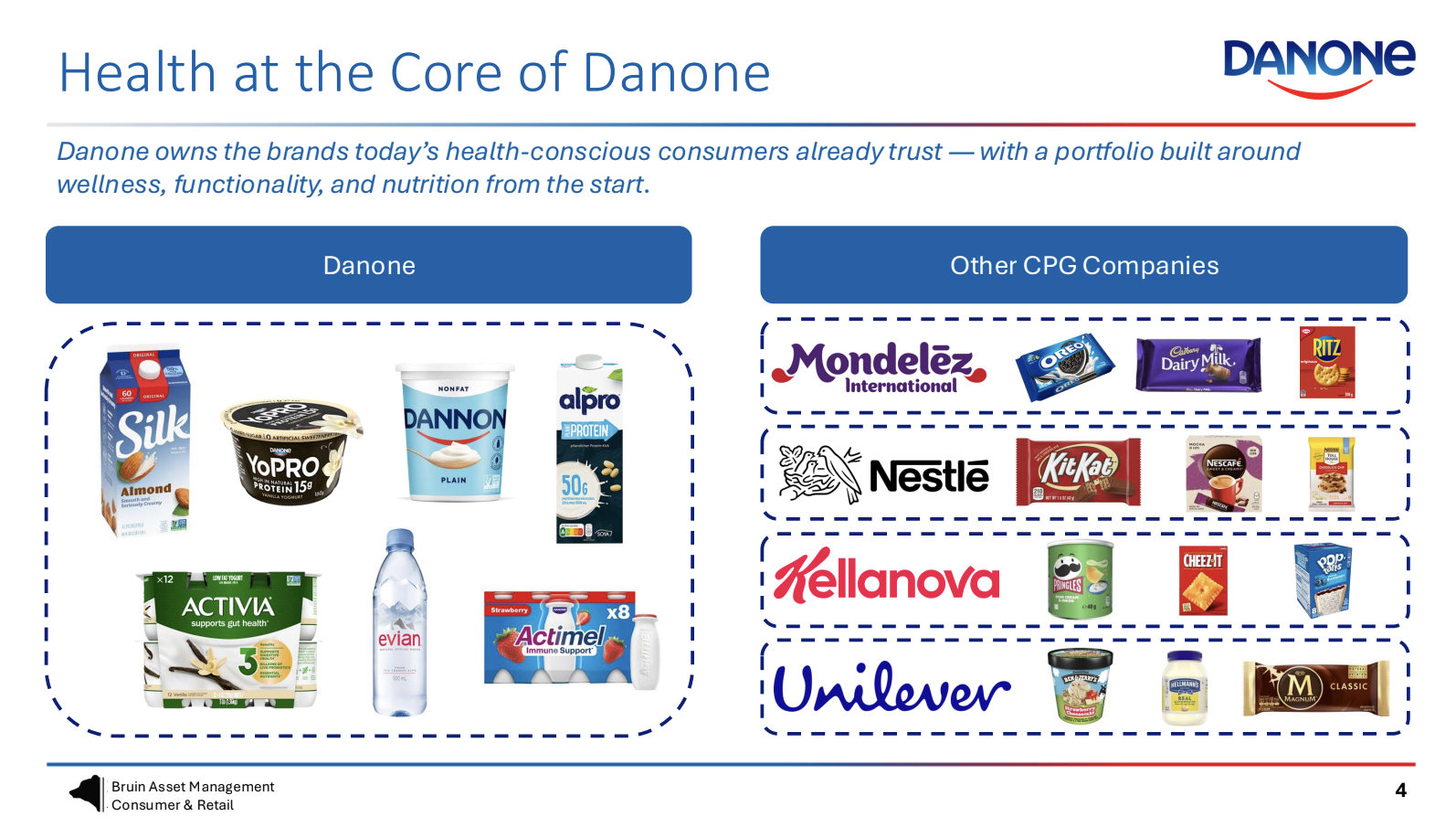

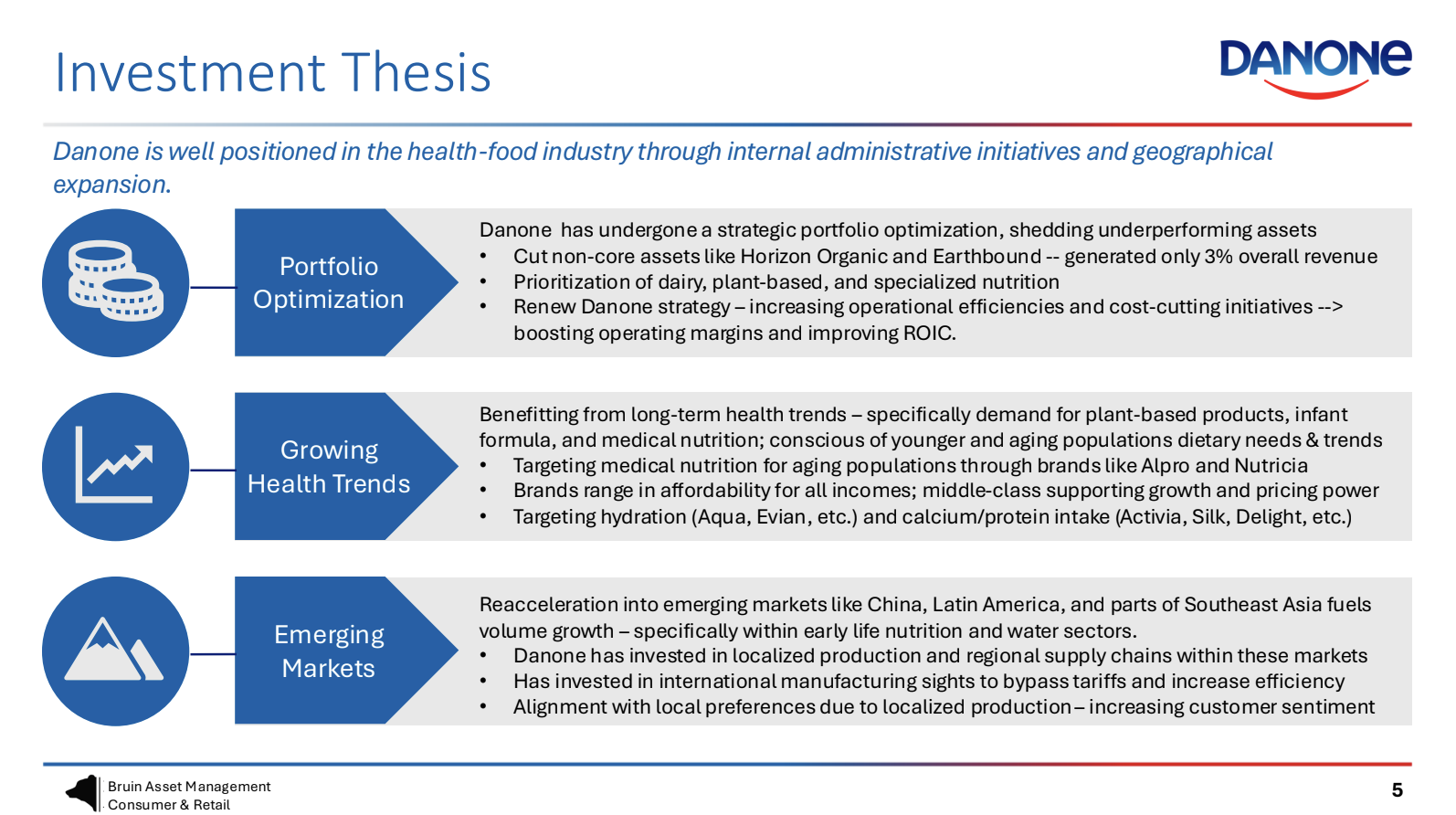

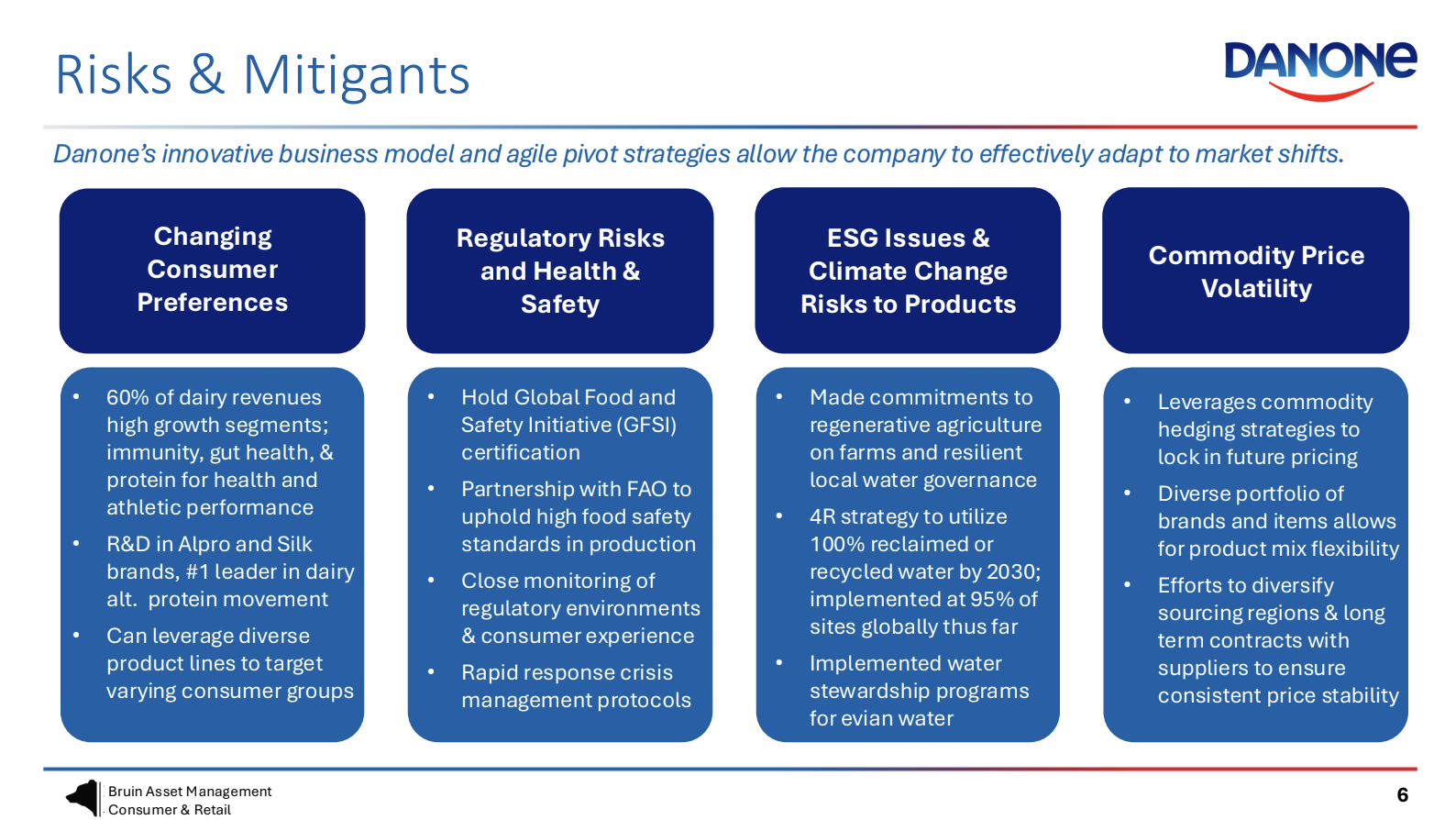

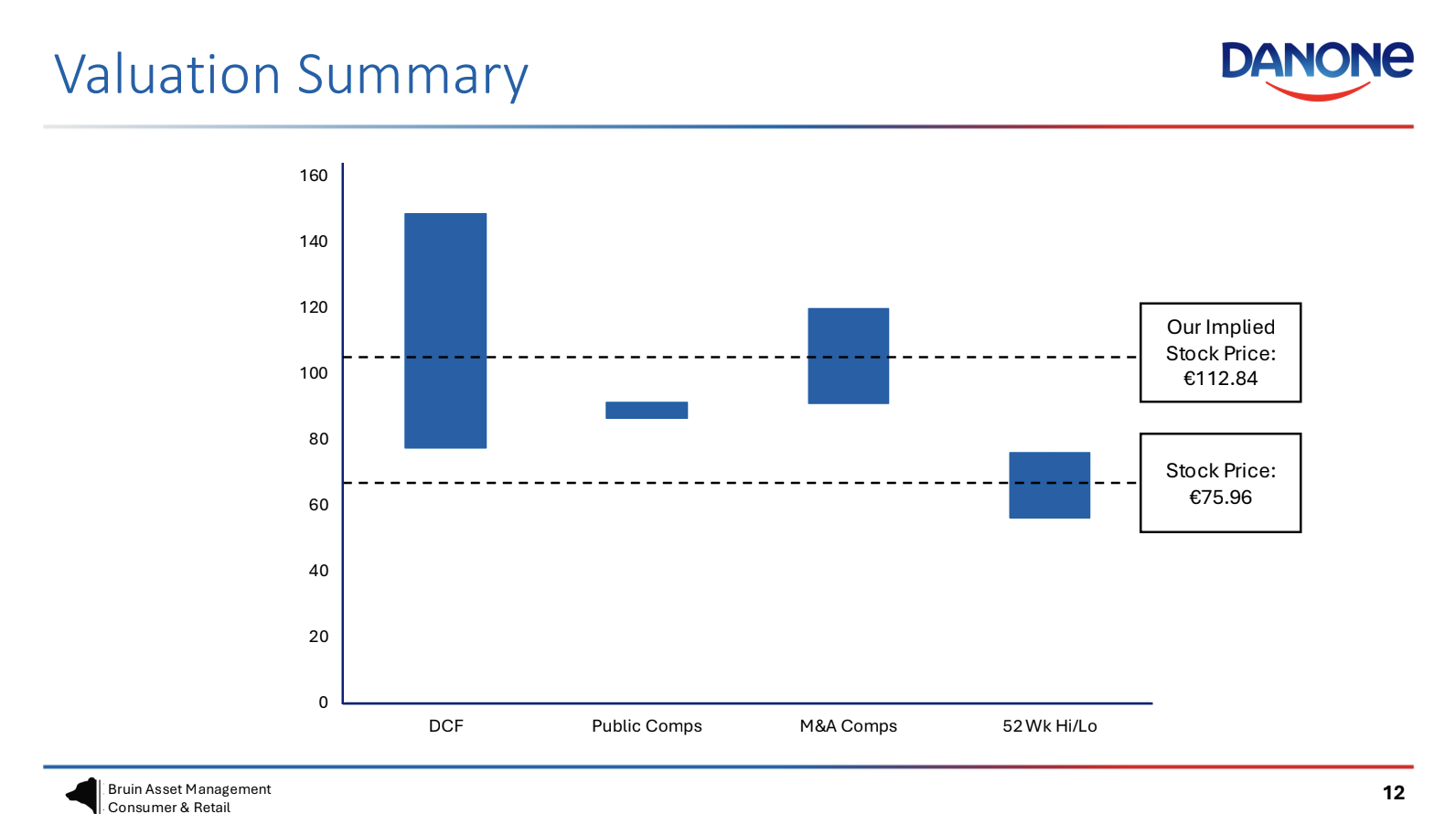

Consumer & Retail

BAM’s Consumer Investment Sector focuses on companies that shape everyday life through products and services across retail, e-commerce, food & beverage, apparel, and leisure industries. Our members analyze consumer behavior, brand strength, pricing power, and shifting macroeconomic trends to identify investment opportunities. From legacy market leaders to disruptive direct-to-consumer startups, we study how changing preferences and innovations drive value creation. This sector equips students with a strong understanding of how to evaluate businesses in dynamic markets where consumer demand is constantly evolving.